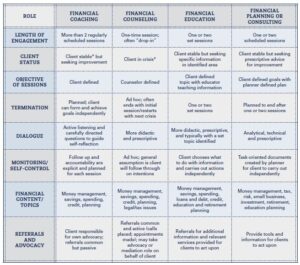

financial coaching v. financial counseling v. financial planning v. financial education

What is financial coaching? Is it the same as financial counseling or financial planning? Are those different from financial education?

It’s a pretty basic question of financial terminology, but an important one. After all, people often interchangeably use these terms – financial coaching, counseling, education, and planning.

The field identification guide helps clarify what service an organization or professional is delivering. It also helps potential clients understand what service to seek out. Someone seeking financial coaching but contacting a financial planner won’t receive the appropriate assistance and may only feel frustrated by the interaction.

Of course, much of the fault lies in the interchangeability of terms used by organizations and professionals. Also, the paper does not tackle the various certifications, standards, licenses, and accrediting organizations that define each role and title. While people widely know and understand the CFP designation, they use other titles like “financial coach” more generically, leading to variations in certification, training, and experience.

Here’s how Money Habitudes is used in each scenario:

Financial Coaching:

- Used to build rapport; a good way to make a first interaction feel less threatening.

- Helps financial coaches understand clients’ financial habits, attitudes, values, behaviors, and emotional triggers.

- Allows clients to pinpoint their strengths and challenges and identify changes they want to make; goal-setting

- Used one-on-one or with couples.

Financial Education:

- Used in financial class settings, often as a first full class or as an icebreaker activity as part of another class (on a topic like budgeting).

- Done individually with class activities or group discussion afterward.

- Often used as a lead-in to identify issues so people decide on other classes to attend (reducing debt, investing, etc.) or as a foundation for financial counseling or coaching.

- Acts as a hook to get people to engage on the topic of money without the stress of dealing with numbers, how much you make, examining expenses, etc., right away.

- Sets a tone of engagement, fun, conversation, and sharing in a class environment.

Financial Counseling:

- Helps identify issues and establish rapport.

- Helps client take ownership; decreases focus on prescriptive solutions to some degree

- Get partners to start a non-threatening dialogue.

Financial Planning:

- A good, non-threatening way to have a “getting to know you” conversation or as a supplement or other intake and discovery tools.

- Serves as a method to understand investing styles, and comfort zone, and to tailor plans to a client.

- Also used to help couples align their financial goals.

Additionally, Money Habitudes is often used to train all of the above professions. It’s typically used to help people understand how different clients see and use money and to help people talk about habits and attitudes as opposed to just talking about skills and facts. It also serves as a sensitivity training tool, aiding individuals who, for instance, are very comfortable with financial plans and numbers, and spreadsheets to collaborate with those unlike them but possessing other strengths.